FHA Financing and Appraisal Guidelines- What to Expect

This post may contain affiliate links. Please read my Disclosure page for more information.

Recently, we had our home on the market. The buyer financed our home with an FHA loan. Contrary to popular belief, FHA does not stand for a first-time home owner’s loan. However, FHA means Federal Housing Administration and is part of the US Department of Housing and Urban Development (HUD), making FHA financing a government loan.

What does it mean when you have FHA financing?

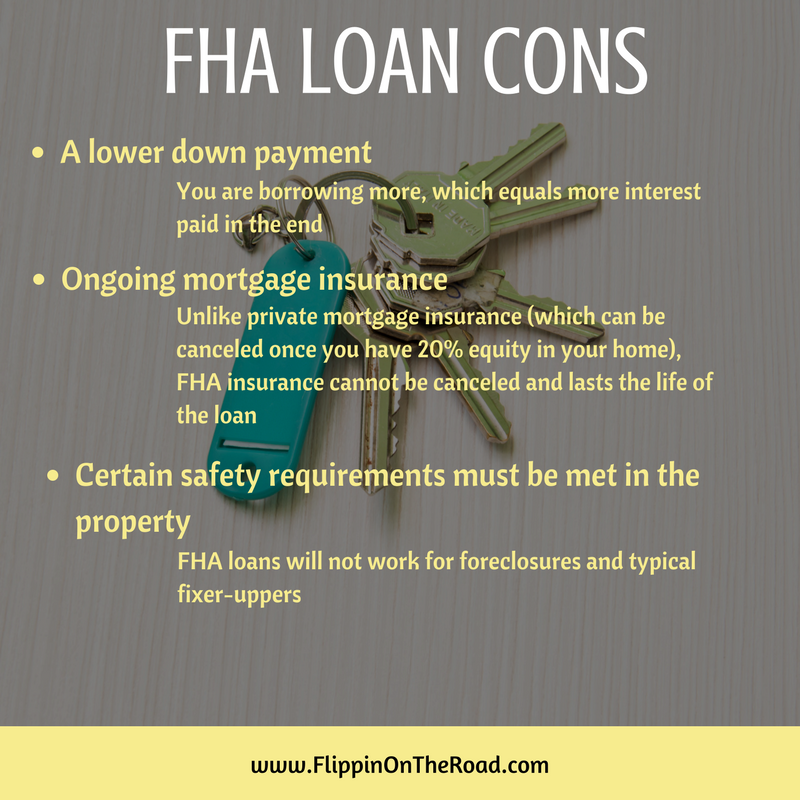

So why doesn’t everyone finance with an FHA loan?

If FHA loans are so attractive, then how come everyone doesn’t finance with FHA loan? Even though an FHA loan has some amazing perks, it’s important to take a look at some of the drawbacks.

What does an FHA appraiser look for?

During the home buying process, a licensed appraiser will typically come out to a home after the inspection period and determine the market value of the home. The appraiser will visit the home and use comparable properties in the area that have recently sold to determine the home’s appraised value. This is a standard practice in all real estate transactions involving home loans. However, when a buyer is financing with an FHA loan, the appraiser also inspects the property to ensure it meets HUDs minimum safety and health standards. In essence, a home with an FHA loan is being inspected twice- once by the inspector hired by the buyer and also by the FHA appraiser.

FHA Appraisals have the added component of inspecting for these safety and health factors in a home.

To get more specific with the above list, here are some of the major safety and health standards an FHA appraiser looks for:

- Foundation in good condition and able to withstand “all normal loads imposed” on it

- Roof keeps moisture from entering house and in good condition

- Heating system sufficient to create ” healthful and comfortable living conditions” inside the home

- Handrails installed on all stairways and steps

- For homes built before 1978 (which may still contain lead-based paint), no chipping or peeling paint present

- Egress window in all bedrooms or bedrooms contains window large enough to allow egress

- Lot graded in a way that water slopes away from the home for proper drainage

- Crawl spaces have ventilation and are relatively dry

- Appliances function properly

- No exposed electrical wires

- GFI (ground fault interrupt) outlets required in bathrooms and kitchens where outlets are within 2 feet of water source

Our experience with FHA appraisal wasn’t too scary!

Yadier and me hanging out by the crawlspace opening while John lays down the vapor barrier for the FHA appraisal/inspection.

When the buyer had an appraisal done on our home that we were selling in Southern Illinois, I was a nervous wreck! We recently renovated the entire home, but I still found myself stressing out over this list. I was worried we would have a list of items to correct and our closing would be delayed. Fortunately, the appraiser only found two items that needed correcting:

- We needed to install GFI outlets in the two outlets on either side of the kitchen sink.

- Our crawl space only had a partial vapor barrier. To prevent moisture from building under the home, the appraiser required the crawl space to have the vapor barrier over the entire area.

Yadier loves helping with repairs. Here we are laying the vapor barrier in the crawl space, and curious Yadier is making sure “Dad” is okay under the house.

Luckily, these items were an easy fix. We corrected both items on that Sunday, and the appraiser came out that Monday to take photos of the repairs. My advice would be to have your home as clean and tidy as if you were having a showing. Always put your best foot forward to make a great impression for the appraiser. Also, as a seller, if you have a sales contract with FHA financing, try to correct as many items as you can before the inspection and appraisal. As a buyer using FHA financing, you now know what kind of items an appraiser will flag when they inspect your future home.

Do you have any stories to share about your experiences with FHA loans? Likes or dislikes?